聚光灯

分析师,信贷产品专员,股票研究分析师,财务分析师,投资分析师,规划分析师,投资组合经理,房地产分析师,证券分析师,信托专员

人们常说有钱才能生钱,而投资是最常见的实现方式。从股票债券到房地产和加密货币,投资始终是长期获利的最可靠途径之一。然而它也具有固有风险——市场因影响企业及整体经济的各类因素而持续波动。 投资回报毫无保障,甚至可能血本无归。

正因如此,精明的投资者才会寻求财务分析师的建议,以制定符合其预算、目标、风险承受能力和时间规划的投资策略。财务分析师通过研究股票、房地产及其他投资品种的表现,进而预测其未来走势。由于分析过程中涉及大量人为因素,这种分析既是科学,亦是艺术。

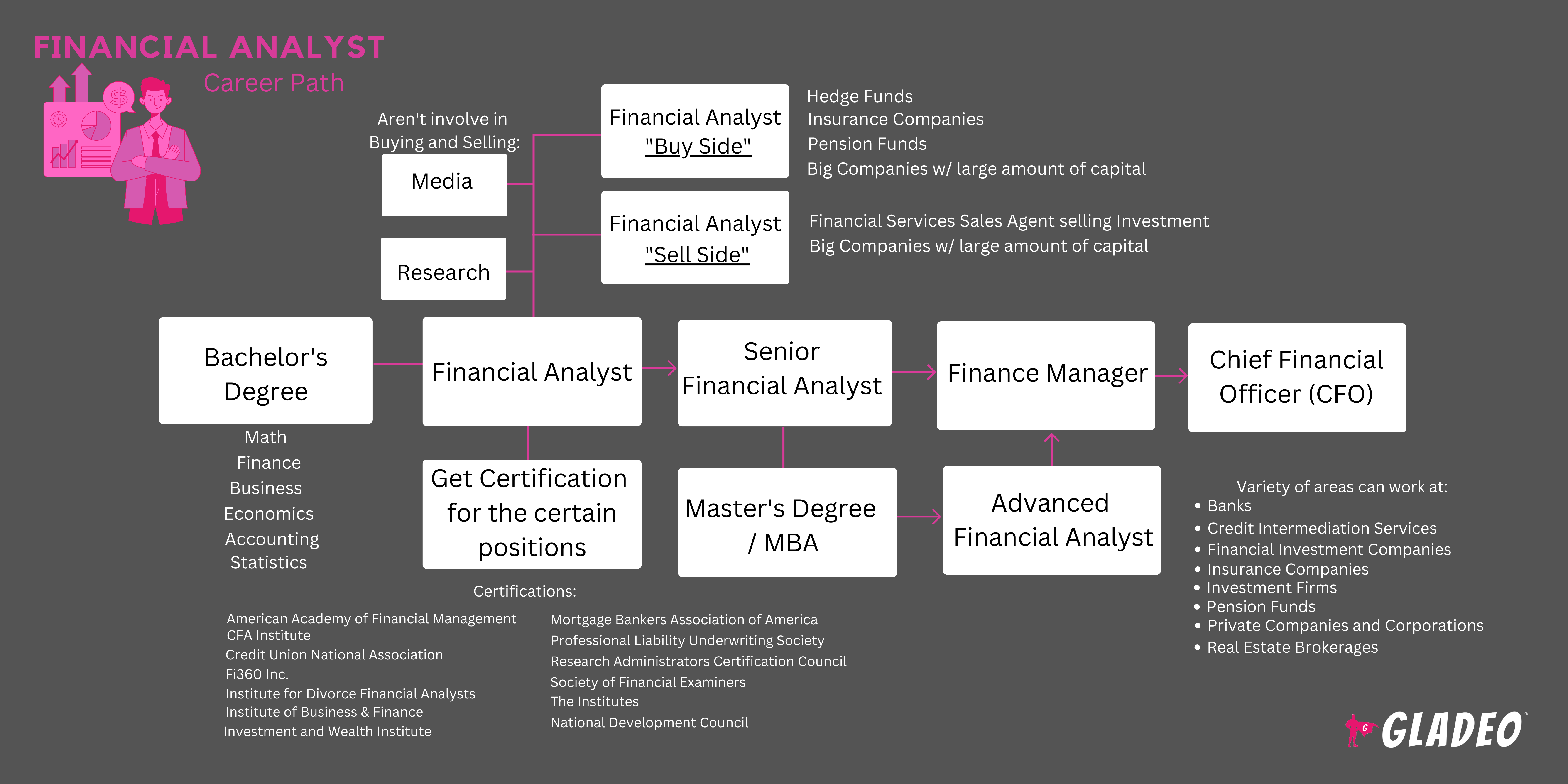

一般而言,金融分析师主要分为两类:专注于"买方"(服务于对冲基金、保险公司、养老基金及拥有大量投资资本的大型企业)或专注于"卖方"(为销售投资产品的金融服务代理商提供支持)。部分分析师则完全服务于媒体及研究机构,这类雇主不参与买卖交易。他们可能专注于特定地区、行业或产品领域。

财务分析是一个广阔的职业领域!财务分析师这一称谓涵盖了金融风险专家、基金与投资组合经理、投资分析师、评级分析师以及证券分析师等多种角色。虽然每个职位的职责范围各不相同,但它们都与充满活力的财务分析领域紧密相连。

- 帮助雇主盈利曾使公司或个人受益

- 作为投资世界的一部分,它对地球上每个人的经济都产生影响。

- 学习股票、债券、实物资产(房地产、黄金、石油等大宗商品)以及加密货币作为投资工具的运作机制

工作日程

财务分析师通常遵循常规工作日安排,根据客户需求可能需要加班或晚间工作。工作地点多为室内,偶尔需要出差。

典型职责

- 审查客户财务报表(利润表、资产负债表、现金流量表),以评估其资本需求、投资预算及风险承受能力。

- 考虑向客户推荐的投资类型和投资组合

- 建议采取投资补救措施、债务重组、再融资及其他解决方案来解决雇主的财务问题。

- 编制报告及演示材料,辅以说明性图表,帮助客户理解各项方案。

- 研究那些股票可能具有投资潜力的公司。必要时进行实地考察。

- 评估历史房地产销售数据,以预测某处房产是否为可行的投资标的。

- 运用财务模型和程序来协助制定投资策略

- 关注本地、国家及全球的经济与商业趋势

- 制定并执行经批准的财务投资、交易及协议行动方案

- 与投资银行家、会计师、公关人员、律师及其他相关方合作

- 评估现有投资表现并建议调整或出售

- 寻求新的机遇以实现多元化发展,提升潜在利润,并降低风险。

- 比较不同行业的证券

- 分析有关价格、收益率和稳定性的数据

- 根据需要与政府机构协作。确保遵守法规和法律。

- 协助客户理解投资的税务影响

额外职责

- 通过阅读财经出版物保持信息更新

- 发掘“绿色”投资机遇

- 根据需要宣传服务以吸引新客户

- 培训并指导新分析师

软技能

- 积极倾听

- 适应性

- 分析性

- 以合规为导向

- 批判性思维

- 注重细节

- 纪律

- 财务敏锐度

- 耐心

- 坚韧

- 劝说

- 规划与组织

- 解决问题的能力

- 怀疑主义

- 明智的判断

- 出色的沟通能力

- 团队合作

- 时间管理

技术技能

- 银行

- 信贷中介服务

- 金融投资公司

- 保险公司

- 养老基金

- 私营公司和企业

- 房地产经纪公司

投资者高度依赖其财务分析师团队的专业能力。稳健的投资决策能带来长期盈利与稳定,这通常意味着企业员工能持续获得工作机会。而不良投资可能导致企业遭受重大财务损失,进而引发业务缩减、员工裁员甚至破产。

市场预期高涨,金融分析师必须努力开展深入研究,建立精准模型,为客户需求预测最佳投资方案。正如Zippia所指出的:"金融分析师通常薪酬丰厚,但往往以牺牲健康的工作生活平衡为代价。"长时间工作和巨大压力导致部分分析师出现职业倦怠。

经济正经历动荡时期,随着股票、共同基金、ETF、房地产和加密货币价格以不可预测的方式波动,投资者如同坐上过山车般起伏不定。这种波动性与大多数金融分析师在财富积累过程中期望看到的稳定态势背道而驰,而近期却鲜有避风港可寻。 储蓄账户、债券、国库券等相对稳健的投资选项虽存在,但这类低风险投资的回报率甚至可能跑不过通胀。与此同时,部分分析师建议利用股价下挫的时机,在股市"打折"期间采取"逢低买入"策略。

货币数字化已成为日益增长的趋势,众多投资者将加密货币和NFT(非同质化代币)视为传统投资工具之外的引人入胜的替代选择。事实上,仅风险投资机构在2021年就向加密货币和区块链领域注入了超过330亿美元资金。与此同时,交易应用彻底革新了普通人的交易方式,进而对整个市场产生了深远影响。

金融分析师或许一直热衷于探索金钱的奥秘——它如何运作,又如何能创造更多财富! 成长过程中,他们或许曾是创业者,在线上或线下开展副业。他们可能热衷于股票和加密货币的操作,通过移动应用进行交易,活跃于在线论坛。在学校里,他们可能偏爱数学、金融、经济学和编程课程。当他人前来寻求投资建议时,他们逐渐意识到:终有一日,这些技能能转化为高薪职业!

- 初级财务分析师职位要求至少拥有经济学、金融学、工商管理、数学或相关专业的学士学位。

- 大型雇主可能希望聘用拥有硕士学位的分析师,例如工商管理硕士(MBA)。

- 某些分析师职位需要掌握物理学、应用数学和工程原理的知识。

- 有多种认证可供选择,它们能帮助您获得特定职位的任职资格。这些认证包括:

• 认证收入专家

• 认证基金专家

- 投资与财富研究院- 认证投资管理分析师

- 美国抵押贷款银行家协会- 认证住宅贷款核保师

- 专业责任承保协会- 注册专业责任承保人

- 研究管理人员认证委员会- 认证财务研究管理人员

- 金融检查员协会-

• 注册财务审查师 - 财务分析师

• 认证财务审查员 - 财务分析师

- 销售产品的金融分析师需通过金融业监管局(FINRA)获取执照。执照通常在分析师开始工作后方可获得。

- 尽早决定是否攻读硕士学位。在同一所学校完成本科和硕士学业可能更为便利。

- 请考虑学费、折扣以及本地奖学金机会(除联邦援助外)的费用。

- 在决定是否报名参加校内课程、在线课程或混合课程时,请考虑您的日程安排和时间灵活性。

- 查看该项目的教师奖项与成就,了解他们的工作成果。

- 查看就业安置数据及该项目校友网络详情

- 考虑申请会计或金融领域的兼职工作

- 在数学、金融、经济学、统计学、商业、物理学以及计算机科学/编程课程中刻苦学习

- 参与学生活动志愿服务,既能管理资金又能学习实用软技能

- 了解各类财务分析师职位,例如财务风险专家、基金与投资组合经理、投资分析师、评级分析师以及证券分析师。

- 提前浏览招聘信息,了解行业平均要求。若已确定目标公司或雇主,可主动申请与该公司在职分析师进行信息性面试,深入了解其工作内容及客户需求。

- 在大学期间寻求实习和合作实践机会

- 记录可能成为未来工作推荐人的姓名及联系方式

- 研读各类投资相关的书籍、文章及视频教程。参与基于实际分析、切合实际的在线讨论组。

- 考虑是否要专注于特定地区、行业或投资类型,以便相应地定制你的教育计划。

- 与专业组织互动,学习知识、分享经验、结交朋友并拓展人脉(详见资源列表 > 网站)

- 尽快考取相关证书,以增强个人资质,提升你在就业市场的竞争力。

- 尽早开始起草简历,并随时补充完善,以免遗漏任何内容。

- 在申请前,尽可能积累一些实践工作经验。与金融、会计和商业相关的工作经历会为你的申请增色不少。

- 进入该领域工作并不需要硕士学位,但研究生学历可能让你在竞争中占得先机。

- 让你的社交圈知道你正在求职。大多数工作机会实际上都是通过人脉关系获得的。

- 查看Indeed、Simply Hired和Glassdoor等招聘网站,以及你感兴趣的公司官网上的招聘页面。

- 请仔细筛选广告,仅在完全符合资格时申请。

- 与金融相关的学徒或合作实践经历能助你打开职场大门。这些经历不仅能为简历增色,还可能为你日后争取到一些个人推荐。

- 联系在职的财务分析师,请教求职技巧

- 前往就业机会最多的地方!金融分析师就业率最高的州依次为纽约州、加利福尼亚州、得克萨斯州、伊利诺伊州和佛罗里达州。

- 许多大型企业会从本地院校项目中招聘毕业生,因此请向你所在大学的项目办公室或就业指导中心寻求帮助,以便联系招聘人员并参加招聘会。

- 职业中心还提供简历撰写和模拟面试辅导服务!

- 提前询问前任教师和主管是否愿意担任个人推荐人。切勿未经许可就擅自列出他们的联系方式,以免令他们措手不及。

- 在Quora上注册账号,向该领域的从业者咨询求职建议。

- 查看财务分析师简历模板获取灵感

- 根据申请的职位量身定制简历,而非向所有雇主发送相同的简历。

- 在简历中列出所有教育背景、技能、培训经历及工作经历,包括投资回报率数据(如适用)。

- 考虑请专业简历撰写人或编辑代为起草或审阅您的简历。

- 财务分析师面试问题集锦,助您从容应对面试

- 着装得体,面试成功!

- 持续为雇主/客户创造强劲的投资回报,并为其构建能够经受经济风暴考验的投资组合。

- 根据需要加班加点,确保为那些托付资金的客户竭尽全力。

- 认真履行管理他人资金的职责

- 理解并遵守所有法律和道德要求

- 运用最先进的程序和技术来实现收益最大化

- 尽可能多地学习财务分析的各个方面,同时专注于你选择的专业领域。

- 预计将从初级职位起步,逐步晋升至更高责任岗位,例如投资组合经理或基金经理。

- 尽早考取FINRA执照,并在积累足够工作经验后获取高级证书。

- 若尚未取得硕士学位,不妨考虑在职攻读MBA夜校课程。

- 当你准备好承担更多或更大的项目时,请告知你的经理。

- 在团队中高效协作,保持冷静专注,并在机遇来临时展现领导力。

- 通过参与专业组织来拓展人脉

担任财务分析师有时压力很大,尤其在经济动荡时期,要获得良好的投资回报更为困难。分析师常常因超出其控制范围的因素导致的结果而受到指责。根据美国劳工统计局的数据,以下是几个值得考虑的相关职业:

- 预算分析师

- 财务经理

- 保险核保员

- 个人理财顾问

- 证券、商品及金融服务销售代理

此外,O*Net Online还列出了以下相关领域:

- 信贷分析师

- 金融风险专家

- 投资基金经理

新闻源

精选职位

在线课程与工具

年薪预期

新员工起薪约为7.9万美元。年薪中位数为9.4万美元。经验丰富的员工年薪可达11.4万美元左右。

年薪预期

新员工起薪约为10.7万美元。年薪中位数为13.2万美元。经验丰富的员工年薪可达17万美元左右。

年薪预期

新员工起薪约为9.2万美元。中位数薪资为每年11.5万美元。经验丰富的员工年薪可达13.3万美元左右。

年薪预期

新员工起薪约为9.3万美元。年薪中位数为11.9万美元。经验丰富的员工年薪可达18.2万美元左右。

年薪预期

新员工起薪约为8.5万美元。年薪中位数为10.4万美元。经验丰富的员工年薪可达12.4万美元左右。