聚光灯

风险经理、内部审计师、认证副主管、认证经理、合规总监、合规运营经理

地球上每个组织都拥有某种财务架构,无论是夫妻店、非营利机构、公司、保险公司还是政府部门。只要涉及资金,必然存在规范资金使用的规章制度。正因如此,多数组织至少配备一名专职财务合规官,以避免陷入法律纠纷。

财务合规专员会仔细审查资产负债表、利润表及其他财务文件。他们会严密筛查差异,确保符合适用的联邦及州法规(以及任何其他需关注的指导方针)。其目标在于发现并预防可能影响雇主财务完整性的疏漏、错误及欺诈行为。

我的职责是审查现行政策、流程、操作规范及工作流,确保公司完全遵守州级与联邦法律法规。若发现可改进之处,我将协助制定降低风险的专项方案。 同时审查供应商合同,评估其服务能力是否满足企业需求,是否具备全面支持我方整体业务的能力,并据此起草正式合同待签。作为工作重点之一,我每月对业务实践进行风险评估,协助识别改进空间,将建议提交管理层,并推动完善文档流程与质量控制审核机制。"贾雷特·赖特·卡森合规经理阿拉斯加美国联邦信用合作社

- 在防范金融不当行为和危机方面发挥关键作用

- 在各类组织中工作的机会

- 与团队协作以提升合规性与风险管理

我深知这份工作的价值在于员工能够为客户及公司内部其他部门提供支持。我得以指导、培养并辅导员工成长为下一代管理团队,引领公司发展。——阿拉斯加美国联邦信用合作社合规经理 贾雷特·赖特·卡森

工作日程

- 财务合规专员通常全职工作,在审计和审查期间可能需要加班。

典型职责

- 制定并实施风险管理策略及合规审计计划、程序、文件、数据库和追踪系统

- 与利益相关方建立关系,确保有效沟通与协作

- 开展内部审计、自我评估以及对财务报表和记录的全面审查,以确保合规并识别潜在风险与违规行为。

- 编制详细的调查结果报告并提出整改措施建议

- 持续监控合规情况;跟进先前发现的问题,确保已得到妥善处理。

- 评估内部控制的有效性。根据需要提出改进建议。

- 确保机构遵守联邦及州法律法规,并提交准确及时的监管申报文件和报告。

- 确保遵守反洗钱和了解你的客户法规

- 与法律和监管团队协作;与外部监管机构和审计师保持联络

- 对员工进行合规要求和最佳实践培训

调查投诉及潜在的金融法规违规行为 - 实施并监督举报政策和程序

- 对潜在的财务不当行为或违规行为进行专项调查

额外职责

- 及时掌握金融法规与检查技术

- 参与专业发展机会

- 为初级官员及其他工作人员提供指导和支持

- 协助准备监管检查和审计

我典型的一天首先从会议开始。我始终坚持召开团队会议,以确定部门内需要优先完成的工作。会议中我聚焦工作重点,确保团队成员达成共识,并预判可能出现的问题。沟通至关重要。 会议结束后,我通常会查看每日任务和生产进度追踪器。这让我能清晰掌握待办事项清单、优先级排序及责任归属。随后我会优先处理最高优先级或可快速完成的任务,逐步推进清单。这有时需要大量阅读合同、法律文件、联邦或州法律等资料。午休后我会转换工作重心,开始专注于团队的培训工作。 我们开发培训项目,这让我能专注于此领域而少受干扰。临近下班时,我会非正式地回顾团队完成的工作、个人任务进展,并制定次日计划及晨会议程。"——阿拉斯加美国联邦信用合作社合规经理贾雷特·赖特·卡森

软技能

- 积极倾听

- 适应性

- 分析性

- 以合规为导向

- 批判性思维

- 注重细节

- 纪律

- 财务敏锐度

- 诚信

- 耐心

- 坚韧

- 劝说

- 规划与组织

- 解决问题的能力

- 怀疑主义

- 明智的判断

- 出色的沟通能力

- 团队合作

- 时间管理

技术技能

- 数据分析与解读,运用Microsoft Excel、Tableau或SPSS等工具识别趋势与异常值

- 熟悉监管合规软件(如SAS、MetricStream或IBM OpenPages),用于监控和确保合规性

- 熟悉金融法规与标准,运用Wolters Kluwer合规解决方案等工具

- 精通财务分析与审计技术及相关程序,运用QuickBooks、SAP 或ACL Analytics等软件进行全面财务审查

- 报告撰写,使用Microsoft Word或Google Docs

- 风险管理,运用Archer或RiskWatch等工具制定并实施有效的风险缓解策略

- 理解银行和金融体系,使用Fiserv、Jack Henry或Oracle Financial Services等平台来管理和监督银行运营

- 银行和信用合作社

- 公司和企业

- 财务咨询公司

- 政府机构

- 保险公司

- 投资公司

- 非营利组织

财务合规官需恪守高度的准确性与诚信标准。他们在识别并缓解雇主机构内部风险方面发挥着关键作用。确保合规以规避罚款或制裁的压力巨大,因此必须保持警惕并注重细节——即便细微疏漏也可能引发严重后果。

该职位需要进行大量研究并持续进修,以跟上不断变化的法律法规。工作时间可能较长,且有时压力较大,但保护组织和消费者免受金融不当行为侵害能带来职业成就感。此外,在此岗位积累的技能和经验还能为晋升该领域高级职位打开大门!

金融行业正日益借助技术手段优化合规流程。自动化、人工智能和区块链技术在发现异常情况和确保透明度方面发挥着不可或缺的作用。监管科技解决方案日益普及,通过简化报告流程、强化风险管理以及降低合规活动的时间与成本,助力合规官有效管理监管要求。

可持续金融以及环境、社会和治理(ESG)法规的重要性日益凸显。因此,金融合规官肩负着确保其所在机构遵守这些严格标准、展现更负责任的企业行为的重任!

- 玩棋盘游戏并探索规则。

- 读书与解决问题。

- 保持个人物品井然有序。

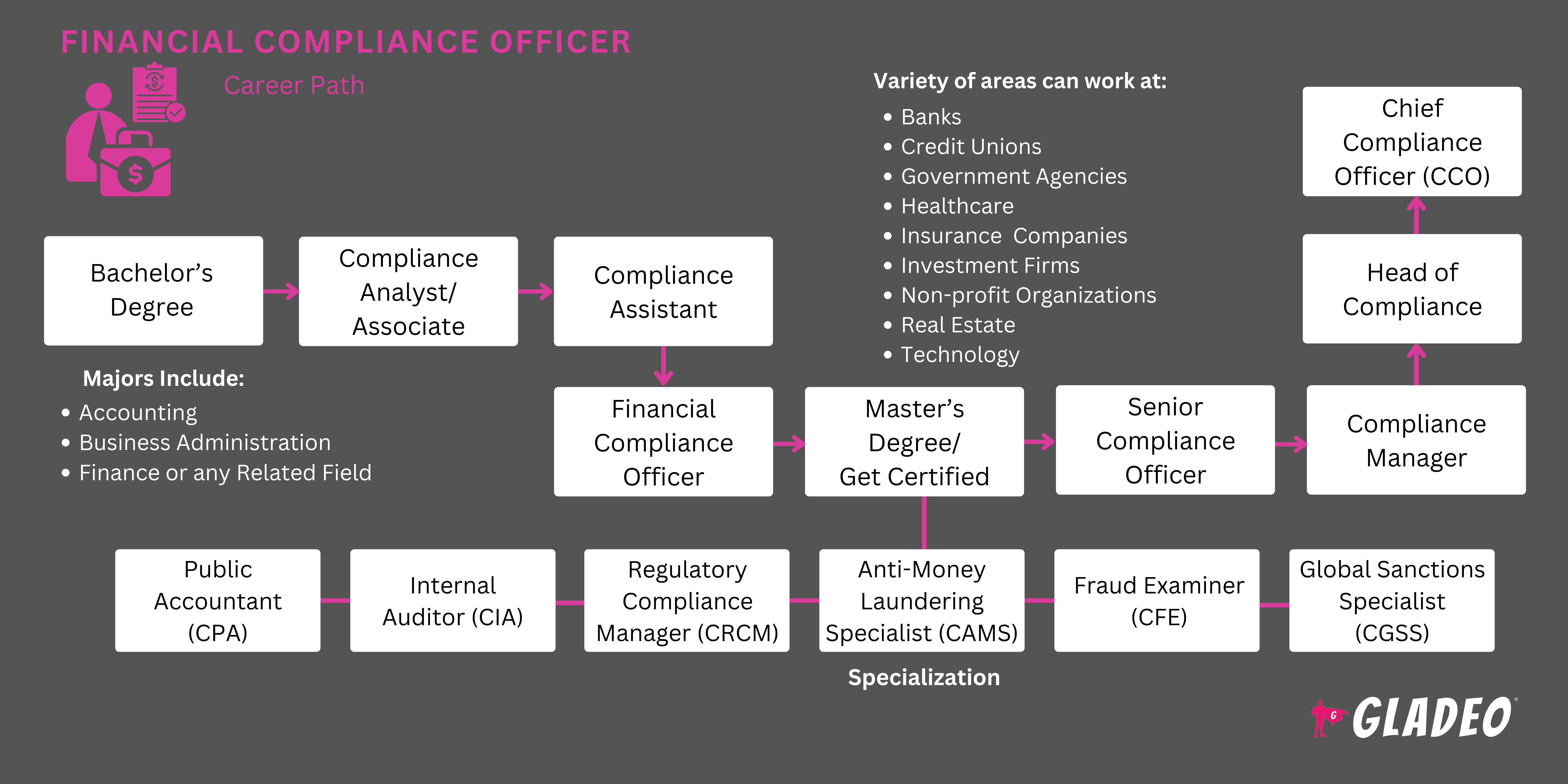

- 要进入该领域,通常需要拥有金融、会计、工商管理或相关领域的学士学位。然而,相关工作经验同样不可或缺。部分公司提供在职培训、实习机会或其他导师计划,但大多数金融合规专员仍需通过逐步晋升才能获得该职位。

- 从业人员需具备财务、审计、合规、金融法规及标准方面的深入知识。他们还应精通合规与财务分析软件,并必须理解风险管理原则与实践。

- 持续的专业发展(通过课程、认证、会议、研讨会和讲座)对于及时了解法规变化和行业最佳实践至关重要。

- 高级职位可能要求硕士学位和/或额外认证,例如:

- 注册会计师(CPA)

- 注册内部审计师(CIA)

- 认证法规合规经理 (CRCM)

- 认证反洗钱专家(CAMS)

- 注册舞弊审查师(CFE)

- 认证全球制裁专家(CGSS)

- 寻找信誉良好且获得认证的金融、会计或工商管理类大学课程,重点关注金融监管、审计及合规性方面的课程设置。

- 若计划攻读硕士学位,请尽早决定。在同一所学校完成本科和硕士学业可能更为便捷,例如通过双学位项目实现。

- 此外,请考虑以下几点:

- 学费成本(包括本州与外州学费标准)。

- 折扣或奖学金选项。

- 联邦援助是否能帮助支付费用。

- 是否选择在校学习、在线学习或混合学习项目。

- 教师的经验与成就。

- 实习或合作学习的机会。

- 毕业生就业统计数据及项目校友网络详情。

- 在数学、金融、经济学、统计学、商业、物理学以及计算机科学/编程课程中刻苦学习

- 参与学生活动志愿服务,既能管理资金又能学习实用软技能

- 考虑申请会计或金融领域的兼职工作

- 提前浏览招聘信息,了解职位的平均要求。若已确定目标公司或雇主,可主动联系该公司在职合规专员安排一次信息性面试,深入了解其工作内容。

- 在大学期间寻求实习和合作实践机会

- 记录可能成为未来工作推荐人的姓名及联系方式

- 研读与金融法规相关的书籍、文章及视频教程。参与在线讨论组。

- 与专业组织互动,学习知识、分享经验、结交朋友并拓展人脉(详见资源列表 > 网站)

- 尽快考取相关证书,以增强个人资质,提升你在就业市场中的竞争力。

- 在申请前,尽可能积累一些实践工作经验。与金融、会计和商业相关的工作经历会为你的申请增色不少。

- 进入该领域工作并不需要硕士学位,但研究生学历可能让你在竞争中占得先机。

- 让你的社交圈知道你正在求职。大多数工作机会仍通过人脉关系获得。

- 查看Indeed、Simply Hired和Glassdoor等招聘网站,以及你感兴趣的公司官网上的招聘页面。

- 查看几个在线财务合规官简历模板,获取排版和措辞灵感。

- 仔细筛选招聘广告,仅在完全符合要求时申请。在简历中加入关键词,例如:

- 反洗钱/了解你的客户合规

- 人工智能在合规领域的应用

- 审计程序

- 区块链技术

- 合规数据库

- 数据分析(Excel、Tableau、SPSS)

- 财务分析

- 财务报告

- 财务系统(QuickBooks、SAP、Fiserv)

- 内部控制

- 监管科技解决方案

- 合规管理软件(SAS、MetricStream、IBM OpenPages)

- 风险管理(RSA Archer、RiskWatch)

- 与金融相关的学徒或合作实践经历能助你打开职场大门。这些经历不仅能为简历增色,还可能为你日后争取到一些个人推荐。

- 前往就业机会最集中的地区!金融行业就业率最高的州包括纽约、加利福尼亚、得克萨斯、伊利诺伊和佛罗里达。

- 许多大型企业会从本地院校项目中招聘毕业生,因此请向你所在大学的项目办公室或就业指导中心寻求帮助,以便联系招聘人员并参加招聘会。

- 职业中心还提供简历撰写和模拟面试辅导服务!

- 请前任教师和主管考虑担任个人推荐人。未经许可,请勿透露他们的联系方式。

- 在Quora上注册账号,向该领域的从业者咨询求职建议。

- 财务合规官面试问题及备答指南。示例问题可能包括:“财务合规官应熟悉哪些关键监管框架?”或“如何处理合规要求与业务目标之间的冲突?”

- 着装得体,面试成功!

"撰写一份有效的简历,不要仅仅罗列岗位职责。着重描述你实际完成的工作内容及表现成效。聚焦于行动、影响和成果:你做了什么,这些工作为公司带来了什么价值,以及你的行动最终取得了怎样的成果。简历的长度应足以说服读者你正是该职位的不二人选。" 贾雷特·赖特·卡森,合规经理,阿拉斯加美国联邦信用合作社

- 保持韧性,时刻恪守专业操守。树立作为一名道德操守的金融合规官的声誉,为问题提供切实可行的建议与解决方案。

- 不断倾听并向其他经验丰富的专业人士学习,这样你就能避免他们可能遇到的问题。

- 展现出承担更多责任、处理日益复杂任务的意愿

- 完成额外的教育和培训,以提升您的技术技能

- 持续拓展你的专业人脉网络。参加各类活动、会议和研讨会。

- 征求主管和同事的反馈意见,以找出需要改进的方面。

- 必要时考虑调动工作地点或更换雇主,以实现职业目标。

- 通过阅读行业出版物和加入专业协会,及时了解行业趋势与变化。

- 培养分析能力,以分析复杂数据并识别潜在合规风险。了解新项目和新技术。

- 培养出色的沟通能力,以便向不同利益相关方清晰阐释复杂的法规。

- 通过领导合规项目、指导初级员工并为团队成功贡献力量,展现领导才能。

- 在审查文件、监督合规活动以及确保满足所有监管要求时,务必注重细节。

- 与监管机构建立牢固关系,以更好地理解其期望,并促进更顺畅的合规审计和检查。

- 通过培训员工、倡导道德行为并确保每个人都理解合规的重要性,在组织内部营造合规文化。

牺牲与奉献。舍弃那些非必要或不该做的事,专注于能助你成长的追求。坚守你的计划,它将引领你达成终极目标。贾雷特·赖特·卡森合规经理阿拉斯加美国联邦信用合作社

财务合规官肩负着确保其所在机构遵守众多法规的专业责任。有时仍会发生失误,导致公司被罚款甚至起诉。在极少数情况下,若合规官自身也存在过失,可能面临个人责任。因此,权衡该职业的回报与潜在风险至关重要!

对于那些希望探索依赖类似技能的替代职业道路的人,请查看我们下面的列表。

- 报关行

- 文档管理专员

- 环境合规检查员

- 平等机会代表

- 财务分析师

- 法证会计师

- 政府财产检查员

- 内部审计师

- 质量控制体系经理

- 法规事务经理

- 风险经理

银行合规部门隶属于更广泛的金融监管机构体系,其核心使命在于协助企业应对法律与道德层面的复杂挑战。若您渴望投身于防范欺诈及其他金融问题的领域,这无疑是理想的职业选择。这类专业人士在最佳状态下,既能助力企业蓬勃发展,又能切实为客户创造价值。

你需要精通法律事务,同时对金融领域有所了解。

新闻源

精选职位

在线课程与工具

年薪预期

新员工起薪约为7.6万美元。年薪中位数为11.5万美元。经验丰富的员工年薪可达14万美元左右。